Energy Demand Forecasting for the Texas Power Grid

February 11, 2022

Write-Up: Kendall Frimodig

Project Team: Brock Bigalke, Katie Hickock, Joel Silverman, Kendall Frimodig

Today I’m going to walk though a team project I recently participated in, focusing on energy demand forecasting. Texas was the subject matter, as it operates as an independent energy grid (other states of US connected) and recently experienced a near meltdown in its basic generating capacity, as a result of the winter storm of Valentines day weekend in 2021. Though the event was unprecedented, neighboring states fared the storm without the loss of life seen in Texas.

Me and my teammates thought a review of their preparedness tools might present an opportunity for positive change.

This blog post is a technical walkthrough of how one might replicate such an analysis, for another state or region. Therefore, lengthwise it will be somewhere in between a readme and a reading through the entire project repository of 5 jupyter notebooks. I will include code snippets but only necessary ones, if you wish to see more comments feel free to read the notebooks on the repo link here.

Scope

Upon investigation, we found that the only open source forecasting tool utilized by grid operators is the US energy information administration (EIA), which makes 12 hour ahead forecasts twice a day. Their model does not perform well with anomalies, and in times of crisis a more short term and reactive forecast could prove more valuable to operators. I believe there is a need for more independant analysis focused on our electrical grid, so I’ll outline (in code snippets) how to access the hourly generation and demand data, and offer some tips for formatting and visualizing the data.

I will also report on our model performance versus the baseline, and how having such a model amidst a crisis could be of more utility.

Relevance

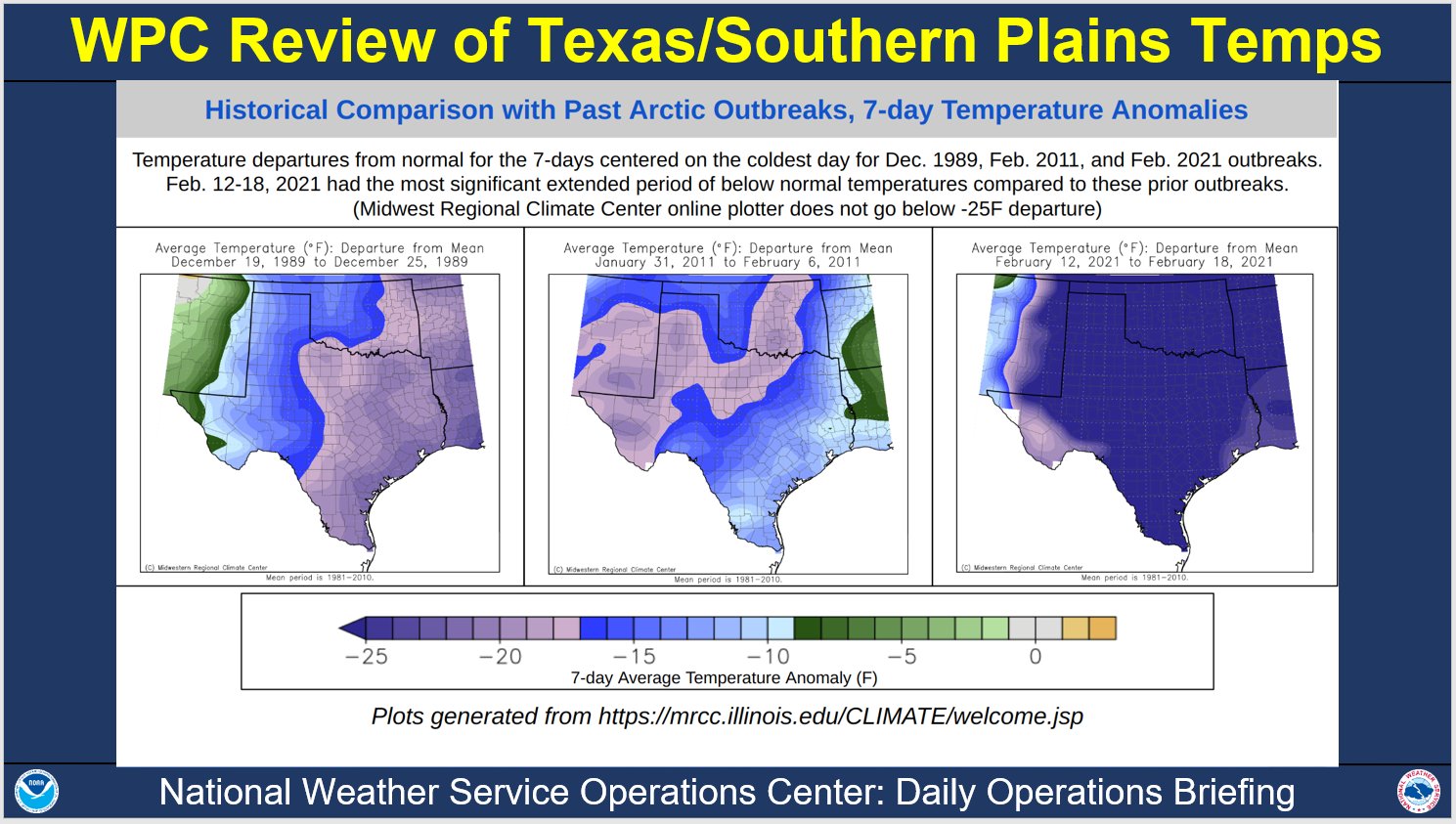

Before I get into some of the reasons an updated forecasting tool might better prepare Texas for another emergency, its worth highlighting that this was

on for the books. Compared to the past two artic events, this recent storm was far more severe

Energy must be produced in real time, to match demand - otherwise load shedding is necessary (temporary or prolonged blackouts) and as you might guess one person does not have the authority to flip the switch for select plants in such a time sensitive situation. If the demand is not sufficiently decreased in time, a generating station’s circuit breaker can trip, and turning the plant back on can take days.

Once one plant goes offline, its far more likely the web of power-plants will collectively fall in a chain reaction - in the worst case the entire state could be without power for a minimum of several days. This is a tricky line to walk since coal or natural gas power plants aren’t acquiring their resources on-site, and sources outside hydroelectric and nuclear are vulnerable to their own environmental conditions to stay online.

In the event of grid overload most other states can reliably pull electricity from neighboring connections, however the lone star state does not benefit form such interconnectivity. Though the figure shows two connections, data indicates little to no transfer of energy from oklahoma and mexico. In other words what little outside connection texas does have, is not comparable on scale to other interconnections.

Youtuber ‘Practical Engineering’ explains how close the texas power crisis was to being a true catastrophe and the mechanics underlying this delicate grid state in an approachable way (link)

Energy Prices

Outside of grid stability there is another upside of having accurate energy demand forecasts, cost savings for the consumer.

Accurate predictions of overall energy demand with respect to a states generation ceiling are crucial, and the rate of change (delta) of demand play a significant role in price. Although your average Texan will pay a agreed upon rate, for protection against such price gouging, many are offered access to market electricity pricing and indeed sign up. If you have 2 electric cars at home, utilizing the lower cost at night could save you alot of cash.

As you can see, the spot price per megawatt increased from the winter average of 20 dollars per megawatt to 1,485, a 7,325% increase where it remained for three days. For those opting into market rate energy, having better forecasts for demand could have saved a fortune (since the EIA forecast was far lower than played out)

Accessing the US Energy Information Agencies API

The EIA provides a variety of databases one can access. Separate data exist for the following:

- Demand (D)

- Net generation (NG)

- Net generation by energy source (NG.__)

- Total interchange (TI)

- Day-ahead demand forecast (DF)

You can specify a single ‘balancing authority’ or in other words operator, a list of operators, or an entire region. We retrieved all the above for Texas’s single operator - ERCOT.

You’ll need to sign up for an API key but this is a simple process and should be approved immediately. If generation from a particular source is ‘0’, the query will return ‘no data’ and mess things up. We built in a if/else function to handle such cases. Thus our api function has three inputs:

- Your key

- the plant(s) code

- query, each listed out above with code

Here’s a summarization of our function, and code to structure the data into one dataframe

How to Pull and Analyze the Data

imports and libraries

# for API section

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import requests

import time

# for viz & pre-processing section

import seaborn as sns

from datetime import datetime as dt

API Query Parameters

Insert your api key here from the EIA website (https://www.eia.gov/opendata/).

api_key= ''

We start with a dictionary with the keys corresponding to the (API defined) query parameters, and values to whatever we would like the columns for such values to be named. In the following custom functions, The keys will be slipped into the API URL to get the appropriate metric, and the values will then be used when creating our pandas dataframe from the request.

query_dict= {'D':'dmnd',

'NG':'ngen',

'TI':'intr',

'DF':'pred',

'NG.COL':'coal',

'NG.WAT':'watr',

'NG.NG':'ngas',

'NG.NUC':'nucl',

'NG.OTH':'othr',

'NG.OIL':'oil',

'NG.SUN':'solr',

'NG.WND':'wind'}

query_list = list(query_dict.keys())

Here is a list of balancing authorities used in the API URL specifically for this project (texas has one, so for any other state, the list will be utilized). Can be amended to include more balancing authorities you are interested in. For example, you could insert a list of all possible balancing authorities to get a national dataset at the most granular level available.

plant_list= ['ERCO']

The first function will be at the core of the second, and will parse the JSON data from each plant/query code combination and return as a dataframe.

def extract_energy(res):

if res.status_code == 200:

ts= res.json()['series'][0]['data'] # location of information from json file

df= pd.DataFrame(ts)

return df

This nested function (above function nested within) returns a dataframe based upon your api_key, plant, and specific query

def make_energy_df(api_key, plant, query):

url = f'https://api.eia.gov/series/?api_key={api_key}&series_id=EBA.{plant}-ALL.{query}.HL'

res = requests.get(url)

if 'data' not in (res.json().keys()):

energy_df = extract_energy(res)

return energy_df

else:

return 'no data'

Putting Everything Together

This nested for-loop aggregates all the dataframes created using the make_energy_df function over each query in the query_list and each plant in the plant_list. It then sorts the dataframe by plant and then by datetime. In other words, one plant at a time, all available hourly data are pulled stepwise for each ‘query’ including specific energy type generation, demand, net generation, and interchange. An exception is made via if / else, since generation data by specific type of energy returns a ‘none type’ rather than 0 if the region doesn’t have any production by oil, for example (and very common)

query_df

- the individual measure and timestamp for a specific plant (solar for example) temporary within the second nested level running through each query code

energy

- temporary in the first nested level, overwritten after each plant’s data is pulled and added to ‘master_energy’. Each ‘query_df’ is added as a single column until each query has been completed

master_energy

- a long form concatenated dataframe where each plant’s hourly data is combined at the end

master_energy= pd.DataFrame()

for plant in plant_list:

energy = pd.DataFrame()

for query in query_list:

if query == 'D':

query_df = make_energy_df(api_key, plant, query)

energy = energy.append(query_df, ignore_index= True)

energy.columns = ['datetime', 'dmnd']

energy.set_index('datetime', inplace= True)

energy['plant']= plant

else:

query_df= make_energy_df(api_key, plant, query)

if 'no data' not in query_df:

query_df.columns= ['datetime', query_dict[query]]

query_df.set_index('datetime', inplace= True)

energy= pd.merge(energy, query_df[query_dict[query]],

on= 'datetime', how= 'outer')

energy['plant']= plant

master_energy= master_energy.append(energy)

if len(plant_list) == 1:

master_energy.sort_values('datetime', ascending= False, inplace= True)

else:

master_energy.sort_values(['plant', 'datetime'], ascending= [True, False], inplace= True)

Check for Missingness

Check the length (for each plant) of the output data. In most cases, more historical data will be available for the aggregate measures, as it appears energy specific generation data is relatively newer.

master_energy.groupby('plant').count()

| dmnd | ngen | intr | pred | coal | watr | ngas | nucl | othr | solr | wind | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| plant | |||||||||||

| ERCO | 60186 | 60168 | 60150 | 60336 | 34032 | 34032 | 34032 | 34032 | 34032 | 34032 | 34032 |

looking at the first 24 hours, you can see only predicted demand is available for the last 12 hours (as predictions are made twice a day. Additionally, data for combined and specific energy generation and interchange are available on a 24-hour lag.

lastday = master_energy[:24]

lastday.fillna(value='.')

| dmnd | plant | ngen | intr | pred | coal | watr | ngas | nucl | othr | solr | wind | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||||||

| 20220523T00-05 | . | ERCO | . | . | 43998.0 | . | . | . | . | . | . | . |

| 20220522T23-05 | . | ERCO | . | . | 47548.0 | . | . | . | . | . | . | . |

| 20220522T22-05 | . | ERCO | . | . | 50570.0 | . | . | . | . | . | . | . |

| 20220522T21-05 | . | ERCO | . | . | 51651.0 | . | . | . | . | . | . | . |

| 20220522T20-05 | . | ERCO | . | . | 52118.0 | . | . | . | . | . | . | . |

| 20220522T19-05 | . | ERCO | . | . | 53340.0 | . | . | . | . | . | . | . |

| 20220522T18-05 | 51259.0 | ERCO | . | . | 53796.0 | . | . | . | . | . | . | . |

| 20220522T17-05 | 50530.0 | ERCO | . | . | 52913.0 | . | . | . | . | . | . | . |

| 20220522T16-05 | 49125.0 | ERCO | . | . | 51510.0 | . | . | . | . | . | . | . |

| 20220522T15-05 | 47591.0 | ERCO | . | . | 50047.0 | . | . | . | . | . | . | . |

| 20220522T14-05 | 45931.0 | ERCO | . | . | 48739.0 | . | . | . | . | . | . | . |

| 20220522T13-05 | 44344.0 | ERCO | . | . | 47191.0 | . | . | . | . | . | . | . |

| 20220522T12-05 | 42869.0 | ERCO | . | . | 45283.0 | . | . | . | . | . | . | . |

| 20220522T11-05 | 41630.0 | ERCO | . | . | 43353.0 | . | . | . | . | . | . | . |

| 20220522T10-05 | 40378.0 | ERCO | . | . | 41383.0 | . | . | . | . | . | . | . |

| 20220522T09-05 | 38705.0 | ERCO | . | . | 39018.0 | . | . | . | . | . | . | . |

| 20220522T08-05 | 37397.0 | ERCO | . | . | 37091.0 | . | . | . | . | . | . | . |

| 20220522T07-05 | 36895.0 | ERCO | . | . | 36486.0 | . | . | . | . | . | . | . |

| 20220522T06-05 | 37086.0 | ERCO | . | . | 36238.0 | . | . | . | . | . | . | . |

| 20220522T05-05 | 37618.0 | ERCO | . | . | 36378.0 | . | . | . | . | . | . | . |

| 20220522T04-05 | 39249.0 | ERCO | . | . | 37053.0 | . | . | . | . | . | . | . |

| 20220522T03-05 | 41023.0 | ERCO | . | . | 38148.0 | . | . | . | . | . | . | . |

| 20220522T02-05 | 43174.0 | ERCO | . | . | 40053.0 | . | . | . | . | . | . | . |

| 20220522T01-05 | 45849.0 | ERCO | . | . | 42420.0 | . | . | . | . | . | . | . |

After 24 hours, all the data is available

master_energy[24:26]

| dmnd | plant | ngen | intr | pred | coal | watr | ngas | nucl | othr | solr | wind | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||||||

| 20220522T00-05 | 48934.0 | ERCO | 48718.0 | -215.0 | 44426.0 | 7074.0 | 69.0 | 13297.0 | 5051.0 | 65.0 | 0.0 | 23162.0 |

| 20220521T23-05 | 52267.0 | ERCO | 52354.0 | 87.0 | 48225.0 | 7039.0 | 98.0 | 16576.0 | 5050.0 | 57.0 | 0.0 | 23533.0 |

For proper timeseries analysis, without imputation, we’ll need to ensure theres no major periods of time with unexplained missing data.

-

If you’re focused specifically on energy type, you will be limited to data from the year

-

If the gaps in aggregate measures (total generation, demand) are missing for a short period of time, you can reliably impute such data

-

If the gaps in such measures are much longer, you should cut off the plant’s dataset from this point

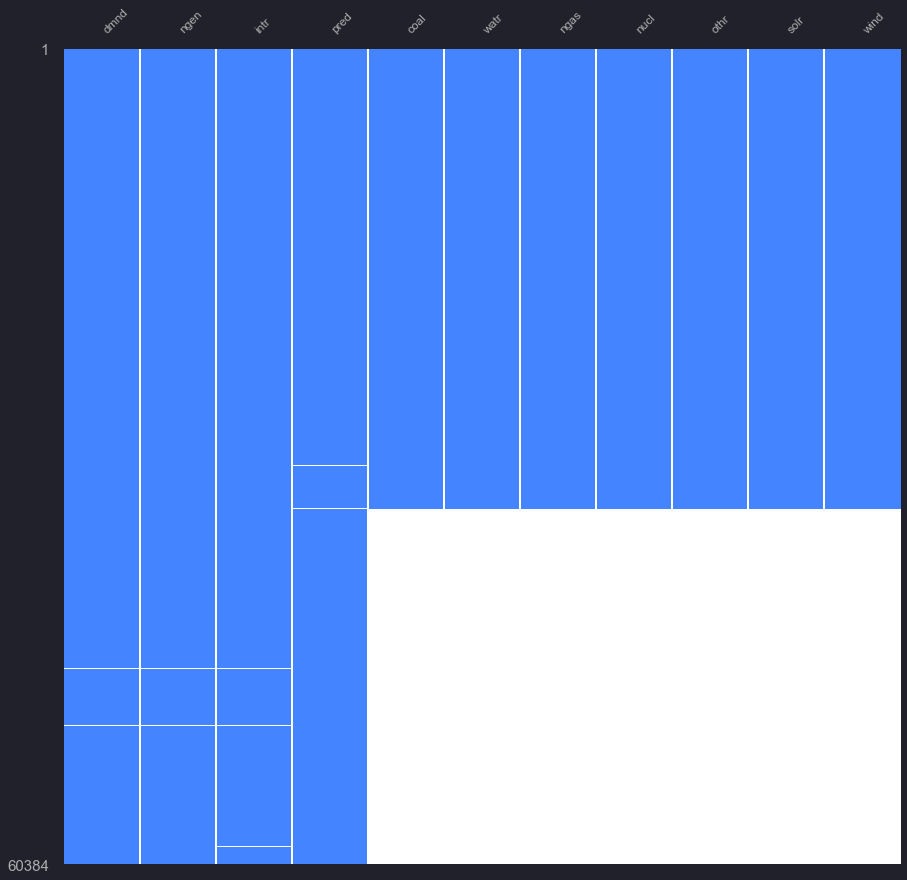

Using the ‘Missingno’ package, we can easily visualize breaks in the data

na_check = master_energy.drop(columns={'plant'})

import missingno as msno

msno.matrix(na_check, sparkline=False, figsize=(15,15), fontsize=12, color=(0.27, 0.52, 1.0));

There appears to be a brief break in forecasted demand, before the time where energy type data falls off, if we want to work with just demand and forecasted demand, we can go back much further.

To narrow down the specific dates, we can run through the predicted dates, and demand and produce flags when we encounter a missing value

first we’ll check the magnitude of missing hour data

na_check.isnull().sum()

dmnd 198

ngen 216

intr 234

pred 48

coal 26352

watr 26352

ngas 26352

nucl 26352

othr 26352

solr 26352

wind 26352

dtype: int64

missing_preds = []

tmp = na_check.isnull()

for i, val in enumerate(tmp['pred']):

if val == True:

ymd = tmp.index[i]

ymd = ymd[:8]

missing_preds.append(ymd)

set(missing_preds)

{'20180702', '20180703', '20181112', '20181113'}

For predictions, we’re just missing data from two dates ( Nov 12th, July 2nd of 2018) (with small overlap on following days)

Referencing the Missingno graph, the specific energy data falls off at this second date for missing forecast (july 2nd, 2018)

Now to check missing demand timeframes

missing_dmnd = []

tmp = na_check.isnull()

for i, val in enumerate(tmp['dmnd']):

if val == True:

ymd = tmp.index[i]

ymd = ymd[:8]

missing_dmnd.append(ymd)

set(missing_dmnd)

{'20160606',

'20160607',

'20160609',

'20160610',

'20160831',

'20160901',

'20170222',

'20170223',

'20170525',

'20170526',

'20170602',

'20170603',

'20180630',

'20180701',

'20181110',

'20181111',

'20220522',

'20220523'}

There are more gaps in recorded demand, for our analysis we chose to model following any missing data, but imputing these gaps in demand and forecast could allow for utilizing more historical data

Saves dataframe to csv file. Can input your own title after ‘../data/’ to make it more understandable for you. It is commented out to not unintentionally overwrite the csv file used for the analyses when this specific project occurred.

master_energy.to_csv('data/all_erco_energy_cst.csv')

Pre-Processing

Before you visualize or model the hourly data, you’ll have to convert the timestamp to a pandas ‘datetime’ data type.

Column names re-formatted to 4 character codes for tidyness when assigning color palletes

nrg = pd.read_csv('./data/all_erco_energy_cst.csv')

nrg['datetime'] = pd.to_datetime(nrg['datetime'].str[:-3],format='%Y%m%dT%H')

Since we’re dealing with time series, we can take advantage of several time aggregation windows. As there are 11 time series models in the ARIMA, VAR, and Exponential Smoothing families to choose from, we need to visualize trends by hour, week, month, and annual windows.

The behavior of historical data determined by a variety of visuals will allow us to narrow down our choice of model, and whether additional parameters such as seasonality and holidays will be required (Ockham’s razor: simplicity is better)

Dropping records that in the data for forecasting that don’t have energy type info

nrg.dropna(inplace=True) # removes 26,000 records from before July 2018

Making an hour column for plotting (0 to 23 hrs)

nrg['hour_num'] = pd.to_numeric(nrg['datetime'].dt.strftime('%H'),downcast='integer')

# making a 'day_night' column, where 6am to 6pm is the day value; rest is night

def calc_col_vals(row):

if row['hour_num'] < 6 or row['hour_num'] > 17:

return 'Night'

elif row['hour_num'] > 5 and row['hour_num'] < 18:

return 'Day'

else:

return 'WTF'

# applying day/night values to new column 'day_night'

nrg['day_night'] = nrg.apply(lambda row: calc_col_vals(row), axis=1)

# checking the value counts

nrg.apply(lambda row: calc_col_vals(row), axis=1).value_counts()

# day of the week

nrg['weekday'] = nrg['datetime'].dt.strftime('%a')

# numbered day of week for chart order

nrg['weekday_num'] = pd.to_numeric(nrg['datetime'].dt.strftime('%w'))

nrg['month'] = nrg['datetime'].dt.strftime('%b')

nrg['month_num'] = nrg['datetime'].dt.strftime('%m')

nrg['month_num'] = pd.to_numeric(nrg['month_num'])

Finally, we’ll create a ‘long’ formatted data frame including our calculations above, where the ‘wide’ dataframes columns are separate dataframes for each energy source, stacked on top of each other

# Melting Energy Sources into a single column for seaborn viz

id_vars = ['datetime', 'month', 'month_num', 'weekday',

'weekday_num', 'day_night', 'hour_num']

value_vars = ['ngen', 'coal', 'watr', 'ngas', 'nucl', 'solr', 'wind']

melt_nrg = pd.melt(nrg, id_vars, value_vars,

var_name='energy_type',

value_name='energy_mwh')

melt_nrg.set_index('datetime')

| month | month_num | weekday | weekday_num | day_night | hour_num | energy_type | energy_mwh | |

|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||

| 2022-05-22 00:00:00 | May | 5 | Sun | 0 | Night | 0 | ngen | 48718.0 |

| 2022-05-21 23:00:00 | May | 5 | Sat | 6 | Night | 23 | ngen | 52354.0 |

| 2022-05-21 22:00:00 | May | 5 | Sat | 6 | Night | 22 | ngen | 55418.0 |

| 2022-05-21 21:00:00 | May | 5 | Sat | 6 | Night | 21 | ngen | 57412.0 |

| 2022-05-21 20:00:00 | May | 5 | Sat | 6 | Night | 20 | ngen | 59173.0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2018-07-03 05:00:00 | Jul | 7 | Tue | 2 | Night | 5 | wind | 4550.0 |

| 2018-07-03 04:00:00 | Jul | 7 | Tue | 2 | Night | 4 | wind | 4465.0 |

| 2018-07-03 03:00:00 | Jul | 7 | Tue | 2 | Night | 3 | wind | 4671.0 |

| 2018-07-03 02:00:00 | Jul | 7 | Tue | 2 | Night | 2 | wind | 6322.0 |

| 2018-07-03 01:00:00 | Jul | 7 | Tue | 2 | Night | 1 | wind | 9950.0 |

237853 rows × 8 columns

Using column to label and column to color dictionaries will allow for obtaining the correct set and order if we make a temporary dataset, such as only specific types of energy.

note oil was not included in the dictionaries as it returned ‘no-data’ for our specific plant of choice. If an ‘oil’ column was added in yours, you must add it to the dictionary - where columns are ordered to reflect the dataframe from left to right

labels = { 'dmnd': 'demand',

'ngen': 'net generation',

'coal': 'coal',

'watr': 'hydroelectric',

'ngas': 'natural gas',

'nucl': 'nuclear',

'othr': 'other',

'solr': 'solar',

'wind': 'wind',

'intr': 'total interchange',

'pred': 'forecast demand'}

colors = { 'dmnd': '#007EB5', # baby blue

'ngen': '#FF5555', # red

'coal': '#ADADAD', # light grey

'watr': '#7FFCE7', # teal

'ngas': '#9580FF', # purple

'nucl': '#8AFF80', # bright green

'othr': '#F4F47B', # golden

'solr': '#FFCA80', # orange

'wind': '#FF80BF', # pink

'intr': '#2A2A2A', # black

'pred': '#FFFF55'} # bright yellow

#FFFFFF white

To demonstrate this flexibility, I’ll create three sets of color palletes and labels for following figures,

- one for all measures

- one for just energy types (leaving out oil, and hydroelectric as they are irrelevant in Texas’s case)

- one for aggregate measures of demand, forecasted demand, total interchange, and net generation

types = ['ngen','coal','watr','ngas','nucl','solr','wind']

agg = ['dmnd','ngen','intr','pred']

all_colors = colors.values()

all_labels = labels.values()

type_colors = [colors[val] for val in types]

type_labels = [labels[val] for val in types]

agg_colors = [colors[val] for val in agg]

agg_labels = [labels[val] for val in agg]

type_colors

['#FF5555', '#ADADAD', '#7FFCE7', '#9580FF', '#8AFF80', '#FFCA80', '#FF80BF']

first to set the plot parameters I spent a great deal of time customizing the plot aesthetic and selecting colors, feel free to use but I would appreciate an attribution!

The parameters and colors were aimed to mimic my default notebook figures when I was using DataSpell IDE, with dracula pro theme

pltparam = {'figure.facecolor': '#21212C',

'image.cmap': u'rocket',

'text.color': '#ADADAD',

'axes.labelsize': 10,

'axes.titlesize': 20,

'axes.axisbelow': True,

'axes.edgecolor': '#454158',

'axes.facecolor': '#21212C',

'axes.grid': True,

'axes.labelcolor': '#ADADAD',

'axes.linewidth': 1.0,

'font.size': 10,

'grid.linewidth': 0.5,

'grid.color': '#454158',

'grid.linestyle': u'-',

'lines.linewidth': 2,

'lines.markeredgewidth': 0,

'lines.markersize': 11,

'lines.solid_capstyle': u'round',

'patch.linewidth': 0.5,

'legend.fontsize': 13,

'legend.frameon': False,

'legend.numpoints': 1,

'legend.scatterpoints': 1,

'xtick.labelsize': 15,

'xtick.major.pad': 11,

'xtick.major.width': 1.5,

'xtick.minor.width': 0.8,

'ytick.labelsize': 15,

'ytick.major.pad': 11,

'ytick.major.width': 1.5,

'ytick.minor.width': 0.8,

'xtick.color': '#ADADAD',

'xtick.direction': u'out',

'ytick.color': '#ADADAD',

'ytick.direction': u'out',

'font.family': [u'sans-serif'],

'font.sans-serif': [u'Arial',

u'DejaVu Sans',

u'Liberation Sans',

u'Bitstream Vera Sans',

u'sans-serif']}

plt.rcParams.update(pltparam)

Visualization

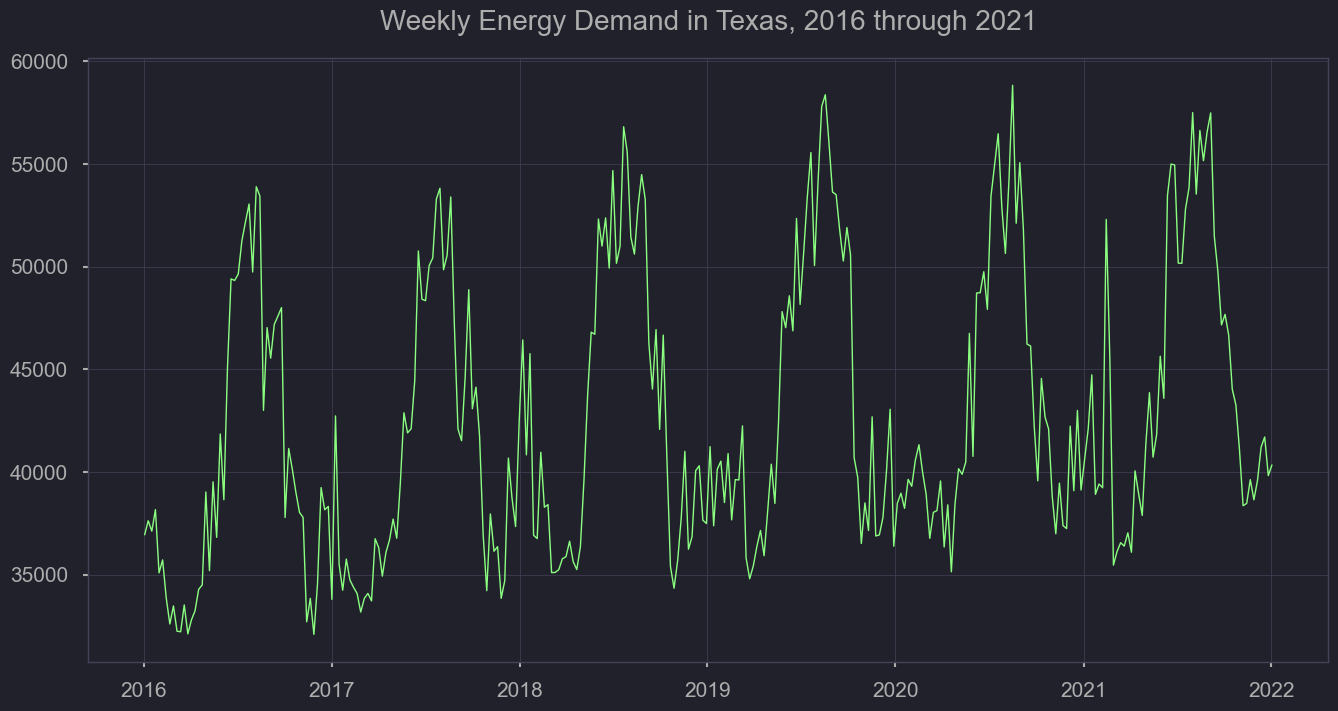

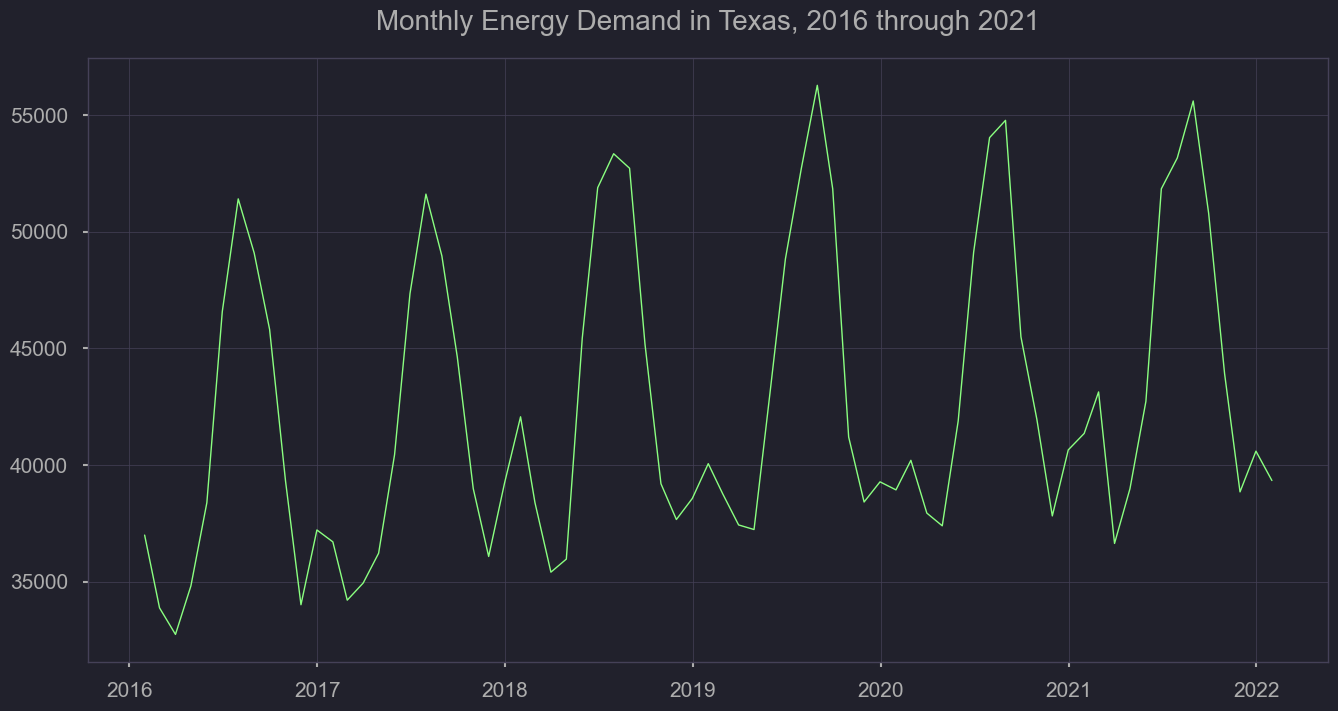

As mentioned previously, we’ll need to understand the level of variation by year, season, and throughout the week. First, we’ll look at how energy demand has increased over the years, rounding up by day from the hour format. We’ll also plot the weekly average to understand how volatility changes throughout seasons, and from year to year.

viz = pd.read_csv('./data/all_erco_energy_cst.csv')

viz['datetime'] = pd.to_datetime(viz['datetime'].str[:-3],format='%Y%m%dT%H')

viz = viz[(viz['datetime'] > '2016-01-01 01:00:00') & (viz['datetime'] < '2022-01-01 01:00:00')]

viz = viz.set_index('datetime')

demand_daily = viz['dmnd'].resample('D').mean()

demand_weekly = viz['dmnd'].resample('W').mean()

demand_monthly = viz['dmnd'].resample('M').mean()

#demand_daily.plot(figsize = (12,6), dpi=100)

plt.figure(figsize = (12,4), dpi=300)

plt.plot(demand_weekly, linewidth=0.5);

#demand_daily.plot(figsize = (12,6), dpi=100)

plt.figure(figsize = (12,4), dpi=300)

plt.plot(demand_monthly, linewidth=0.5);

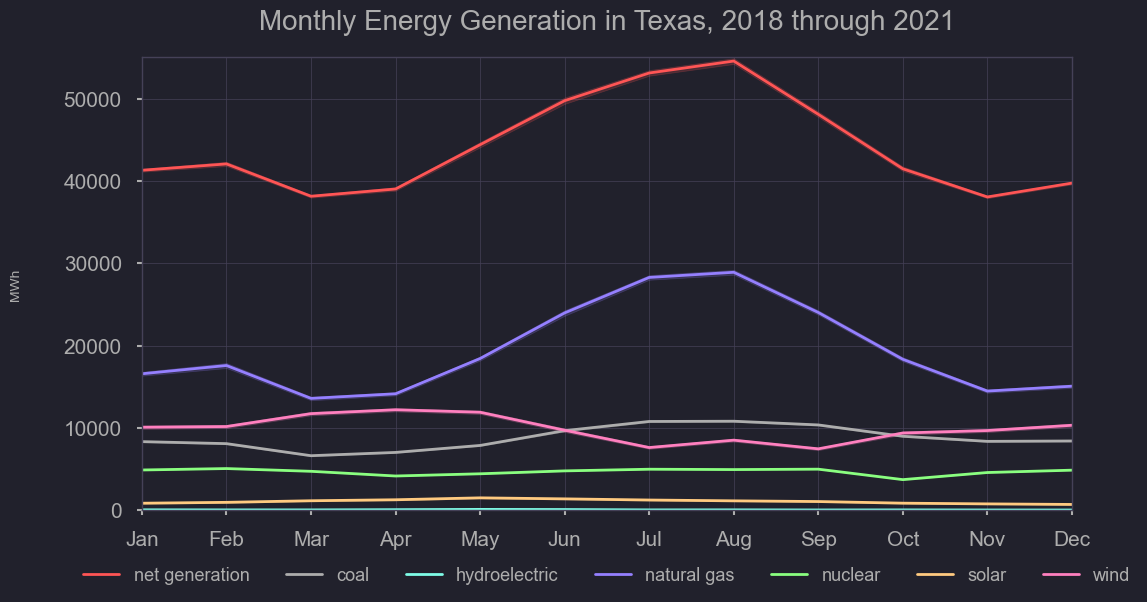

Getting an idea of how energy production, on average, differs from month to month

figtitle = "Monthly Energy Generation in Texas, 2018 through 2021"

plt.figure(figsize=(12,6), dpi=100)

sns.lineplot(x='month_num',

y='energy_mwh',

hue='energy_type',

palette=type_colors,

data=melt_nrg,

legend='brief',

dashes=False)

plt.xticks(ticks=[1,2,3,4,5,6,7,8,9,10,11,12],

labels=['Jan','Feb','Mar','Apr','May','Jun',

'Jul','Aug','Sep','Oct','Nov','Dec']) #use ticks to get months

plt.legend(bbox_to_anchor=(0.5, -0.2, 0., 0.5), loc='lower center',

ncol=len(type_colors), labels=type_labels)

plt.ylabel("MWh", labelpad=30)

plt.ylim(0,55000)

plt.xlabel("", labelpad=30)

plt.xlim(1,12)

plt.title(figtitle, pad=20);

#plt.savefig('../output/' + figtitle + '.png', dpi=300);

As you can see, the contribution of solar, and hydroelectric are miniscule for Texas. Some states like Washington, source over half of their generation for hydroelectric sources. Given it’s geography and resources, Texas primarily relies on wind, natural gas, and coal for it’s energy. Nuclear provides a basline, though its consistency makes these other three sources primary considerations in times of additional energy demand. Knowing the primary three dynamic sources of energy for Texas, we’ll investigate their fluctuations further

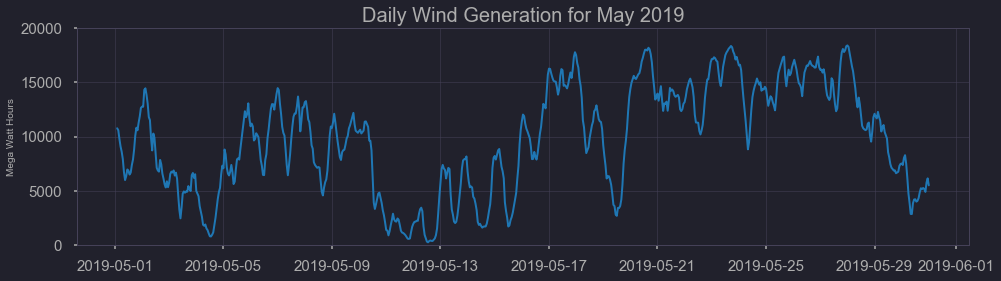

df = nrg[(nrg['datetime'] > '2019-05-01 01:00:00') & (nrg['datetime'] < '2019-05-31 01:00:00')].set_index('datetime')

figtitle = "Daily Wind Generation for May 2019"

plt.figure(figsize=(16,4))

sns.lineplot(x='datetime', y='wind', data= df)

plt.ylim(bottom=0, top=20000)

plt.title(figtitle)

plt.xlabel('')

plt.ylabel("Mega Watt Hours")

#plt.savefig('../output/' + figtitle + '.png', dpi=300)

Text(0, 0.5, 'Mega Watt Hours')

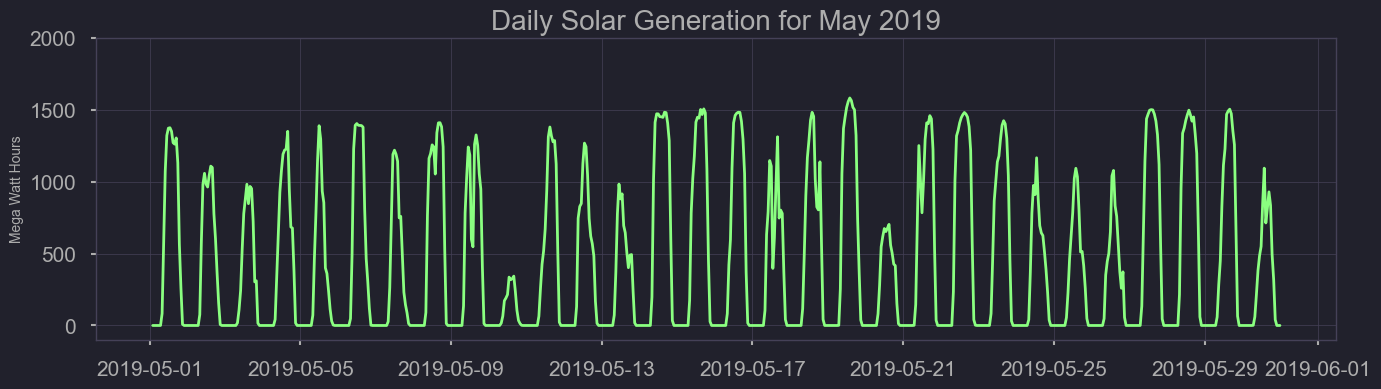

The benefit of Texas having such a large portion of it’s energy come from wind, is that understanding when more supplemental energy from coal and natural gas is needed can be estimated using historical weather data. On a weekly basis, estimating the offset wind energy contributes could allow proper stocking of fossil fuel sources. Despite this, wind energy has great hour to hour, day to day variation, and presents some challenges. As you can see here, the limited use of solar energy still presents a better consistency.

df = nrg[(nrg['datetime'] > '2019-05-01 01:00:00') & (nrg['datetime'] < '2019-05-31 01:00:00')].set_index('datetime')

figtitle = "Daily Solar Generation for May 2019"

plt.figure(figsize=(16,4))

sns.lineplot(x='datetime', y='solr', data= df)

plt.ylim(bottom=-100, top=2000)

plt.title(figtitle)

plt.xlabel('')

plt.ylabel("Mega Watt Hours");

#plt.savefig('../output/' + figtitle + '.png', dpi=300)

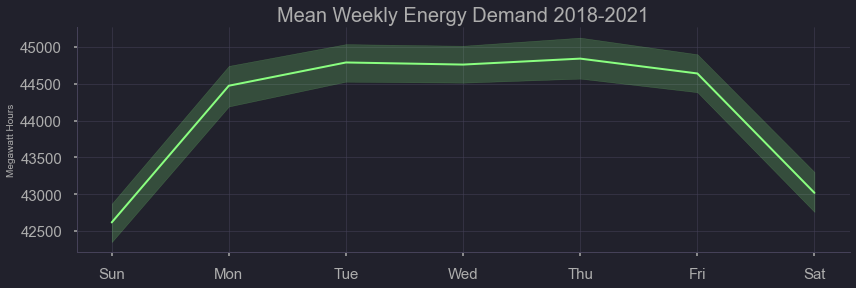

Here we can see the effects of ‘day of week’

#plt.figure(figsize=(9,6));

figtitle = "Mean Weekly Energy Demand 2018-2021"

sns.relplot(x="weekday", y='demand',kind="line", color='#007EB5',

data= nrg.sort_values(by='weekday_num'), height= 4,

aspect=3).set(title= figtitle, xlabel='', ylabel='Megawatt Hours');

#plt.savefig('../output/' + figtitle + '.png', dpi=300)

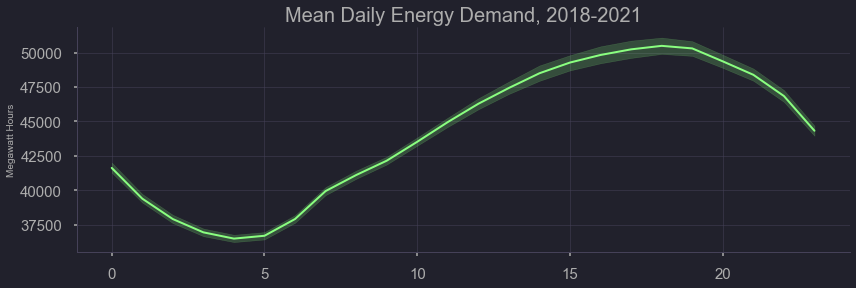

Here we can see the effects of time of day

figtitle = "Mean Daily Energy Demand"

#plt.figure(figsize=(9,6));

sns.relplot(x="hour_num", y='demand',kind="line",

data=nrg, height=4, aspect=3).set(xlabel='',ylabel='Megawatt Hours', title=figtitle);

#plt.savefig('../output/' + figtitle + '.png', dpi=300)

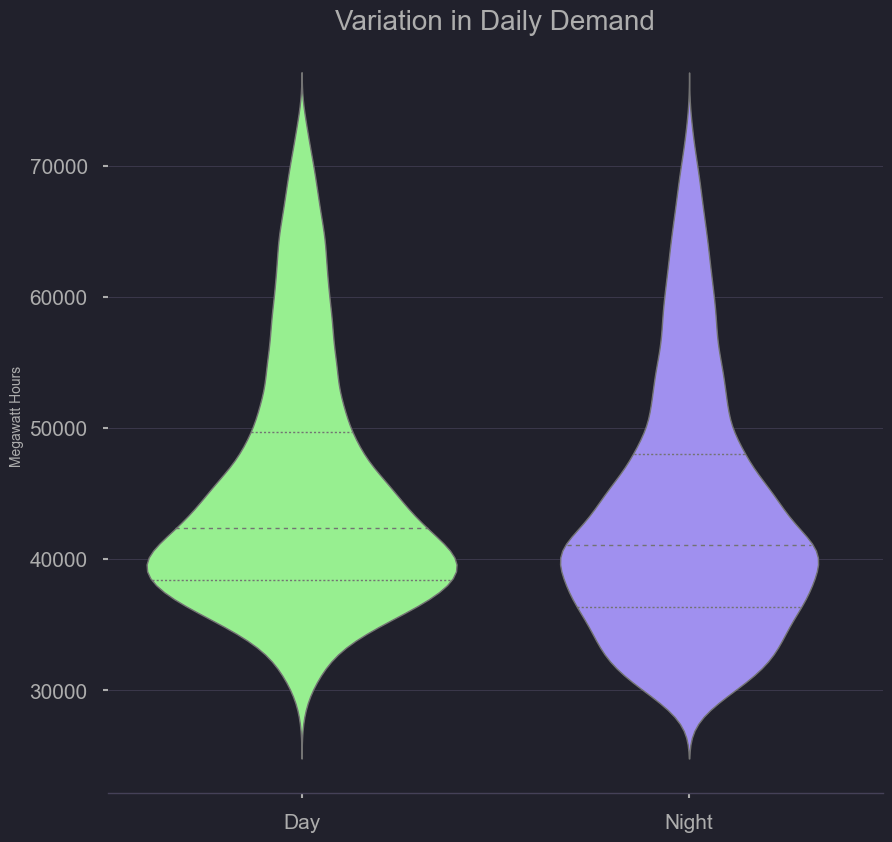

Here we can see the variation of demand at night at during the day. There is wide variation but more-so at night

plt.figure(figsize=(6,6));

figtitle = "Variation in Daily Demand"

sns.violinplot(data=nrg,

x="day_night", y="demand", order=['Day','Night'],

split=False, inner="quart", linewidth=1,

palette='viridis_r').set(title=figtitle,ylabel='Megawatt Hours')

sns.despine(left=True)

#plt.savefig('../output/' + figtitle + '.png', dpi=300) #6am to 6pm and 6pm to 6pm

Modeling

Given the volatility and numerous temporal trends present in the data, we chose to go with a model that doesn’t retain too much knowledge. This would serve a different purpose as the EIA’s 12 hour ahead model, in that it would only predict an hour ahead, but be more reactive to unexpected changes. this is because the Triple exponential smoothing model makes predictions upon a short time window, and thus running the model on historical data can serve as our predictive performance

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import requests

import time

nrg = pd.read_csv('./data/all_erco_energy_cst.csv',index_col='datetime')

# fcast = pd.read_csv('../data/erco_forecast.csv',index_col='datetime')

nrg.head(2)

| demand | plant | net_generation | coal | hydro | natural_gas | nuclear | other | solar | wind | total_interchange | forecast | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||||||

| 20220206T11-06 | 49854.0 | ERCO | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 52270.0 |

| 20220206T10-06 | 53017.0 | ERCO | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 55237.0 |

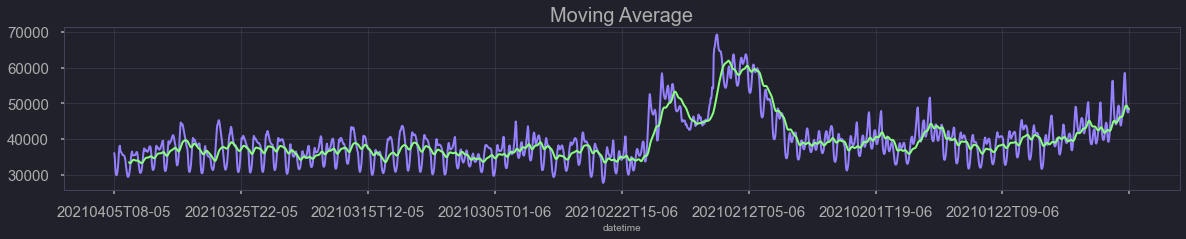

nrg['demand'][10000:12000].rolling(30).mean().plot(figsize=(20,3), kind='line',title='Moving Average',color='#007EB5')

nrg['demand'][10000:12000].plot(figsize=(20,3), kind='line', color='#EC5064')

<AxesSubplot:title={'center':'Moving Average'}, xlabel='datetime'>

Model 1 - Moving Average model: takes an average of the 30 data points(hours) to predict the next hour’s demand. Does not match peaks and troughs well.

nrg = nrg.dropna()

d = nrg['demand']

cols = len(d) #Data Science for Supply Chain Management by Nicolas Vandepunt

d = np.append(d,[np.nan]*1)

f,a,b = np.full((3, cols+1),np.nan)

a[0] = d[0]

b[0] = d[1] -d[0]

for t in range(1,cols):

f[t] = a[t-1] + b[t-1]

a[t] = 0.4*d[t] + (1-0.4)*(a[t-1]+b[t-1])

b[t] = 0.2*(a[t]-a[t-1]) + (1-0.2)*b[t-1]

for t in range(cols, cols+1):

f[t] = a[t-1] + b[t-1]

a[t] = f[t]

b[t] = b[t-1]

df_three = pd.DataFrame.from_dict({'Demand':d,'Forecast':f,'Level':a, 'Trend':b,'Error':d-f})

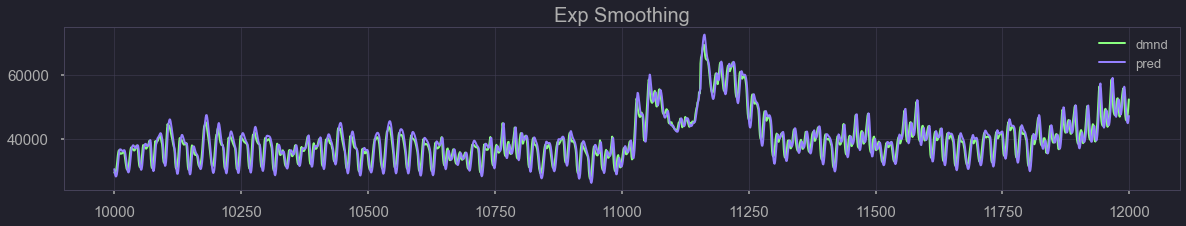

df_three[['Demand','Forecast']][10000:12000].plot(figsize=(20,3), kind='line',title='Exp Smoothing',color=['#007EB5','#EC5064'])

<AxesSubplot:title={'center':'Exp Smoothing'}>

Model 2 - Simple Exponential Smoothing: Model fits better than moving average but does not account for seasonality. The bias is -0.34, MAE: 3386, and RMSE: 4189.

def mae_function(df):

###From Data Science for Supply Chain Management by Nicolas Vandepunt###

dem_ave = df.loc[df['Error'].notnull(), 'Demand'].mean()

bias_abs = df['Error'].mean()

bias_rel = bias_abs / dem_ave

print('Bias: {:0.2f}, {:.2%}'.format(bias_abs,bias_rel))

mae_abs = df['Error'].abs().mean()

mae_rel = mae_abs / dem_ave

print('MAE: {:0.2f}, {:.2%}'.format(mae_abs,mae_rel))

rmse_abs = np.sqrt((df['Error']**2).mean())

rmse_rel = rmse_abs / dem_ave

print('RMSE: {:0.2f}, {:.2%}'.format(rmse_abs,rmse_rel))

def seasonal_factors_mul(s,d,slen,cols):

for i in range(slen):

s[i] = np.mean(d[i:cols:slen])

s /= np.mean(s[:slen])

return s

def exp_smooth_funct(d, slen=12, extra_periods=1, alpha=0.4, beta=0.4, phi=0.9, gamma=0.3):

###Data Science for Supply Chain Management by Nicolas Vandepunt###

cols = len(d)

d = np.append(d,[np.nan]*extra_periods)

f,a,b,s = np.full((4, cols+extra_periods), np.nan)

s = seasonal_factors_mul(s,d,slen,cols)

a[0] = d[0]/s[0]

b[0] = d[1]/s[1] - d[0]/s[0]

for t in range(1,slen):

f[t] = (a[t-1] + phi*b[t-1])*s[t]

a[t] = alpha*d[t]/s[t] + (1-alpha)*(a[t-1]+phi*b[t-1])

b[t] = beta*(a[t]-a[t-1]) + (1-beta)*phi*b[t-1]

for t in range(slen,cols):

f[t] = (a[t-1] + phi*b[t-1]) * s[t-slen]

a[t] = alpha * d[t]/s[t-slen] + (1-alpha)*(a[t-1]+phi*b[t-1])

b[t] = beta*(a[t]-a[t-1]) + (1-beta)*phi*b[t-1]

s[t] = gamma*d[t]/a[t] + (1-gamma)*s[t-slen]

for t in range(cols,cols+extra_periods):

f[t] = (a[t-1] + phi*b[t-1])*s[t-slen]

a[t] = f[t]/s[t-slen]

b[t] = phi*b[t-1]

s[t] = s[t-slen]

df_funct = pd.DataFrame.from_dict({'Demand':d,'Forecast':f,'Level':a, 'Trend':b,'Season':s,'Error':d-f})

return df_funct

mae_function(df_three)

Bias: -0.34, -0.00%

MAE: 3385.78, 7.68%

RMSE: 4188.94, 9.50%

nrg_dem = nrg['demand']

tri_exp = exp_smooth_funct(nrg_dem, slen=12000, extra_periods=1, alpha=0.4, beta=0.4, phi=0.8, gamma=0.2)

tri_exp.shape

(31461, 6)

tri_exp[['Demand','Forecast']][10000:12000].plot(figsize=(20,3), kind='line',title='Triple Exp Smoothing',color=['#007EB5','#EC5064'])

<AxesSubplot:title={'center':'Triple Exp Smoothing'}>

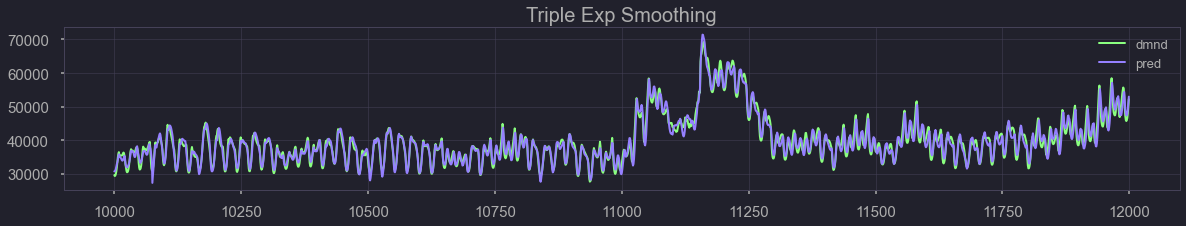

Model 3 - Triple Exponential Smoothing: Takes exponential smoothing and introduces seasonality parameter. The bias is -0.93, MAE: 1337, and RMSE: 1687.

mae_function(tri_exp)

Bias: -0.93, -0.00%

MAE: 1337.39, 3.03%

RMSE: 1687.98, 3.83%

tri_exp.shape

(31461, 6)

tri_exp.notnull().shape

(31461, 6)

tri_exp

| Demand | Forecast | Level | Trend | Season | Error | |

|---|---|---|---|---|---|---|

| 0 | 51910.0 | NaN | 52013.663869 | -976.914964 | 0.998007 | NaN |

| 1 | 52424.0 | 52624.693779 | 51153.978701 | -812.793250 | 1.027181 | -200.693779 |

| 2 | 52723.0 | 52788.768409 | 50478.575483 | -660.302047 | 1.045245 | -65.768409 |

| 3 | 52136.0 | 52375.841315 | 49858.840107 | -564.839133 | 1.048558 | -239.841315 |

| 4 | 50843.0 | 51382.429458 | 49199.492629 | -534.861775 | 1.039983 | -539.429458 |

| ... | ... | ... | ... | ... | ... | ... |

| 31456 | 41776.0 | 37506.125723 | 46603.199635 | 207.729000 | 0.852441 | 4269.874277 |

| 31457 | 43206.0 | 38273.522750 | 49180.333281 | 1130.563378 | 0.830381 | 4932.477250 |

| 31458 | 45279.0 | 40938.825180 | 52208.701486 | 1754.017704 | 0.827366 | 4340.174820 |

| 31459 | 48214.0 | 44750.632056 | 55271.581951 | 2067.080684 | 0.842234 | 3463.367944 |

| 31460 | NaN | 41498.210044 | 56925.246498 | 1653.664547 | 0.728995 | NaN |

31461 rows × 6 columns

Model Interperetation

Compares EIA historical forecast, for ERCO network (texas) versus the actual demand. Those forecasts are set 24 hours in advance and the model does not re-fit every hour. Compared is our model in the second half, which re-fits each hour, starting sequentially nn

from statsmodels.tsa.api import SimpleExpSmoothing

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from my_functions import *

import warnings

warnings.filterwarnings('ignore')

from datetime import datetime

parser = lambda x: datetime.strptime(x, '%Y%m%dT%HZ')

nrg = pd.read_csv('./data/all_erco_energy.csv', parse_dates=['datetime'], date_parser=parser)

# Check to see last day where data is complete (first day where null)

nrg_na = nrg[nrg['demand'].isnull()]

nrg_na.index[0]

28379

date_floor = '2018-11-12'

date_ceil = '2022-02-06 05'

nrg = nrg[(nrg['datetime'] > date_floor) & (nrg['datetime'] < date_ceil)].set_index('datetime')

print(nrg.shape)

(28366, 12)

print(nrg.index[0])

print(nrg.index[-1])

2022-02-06 04:00:00

2018-11-12 07:00:00

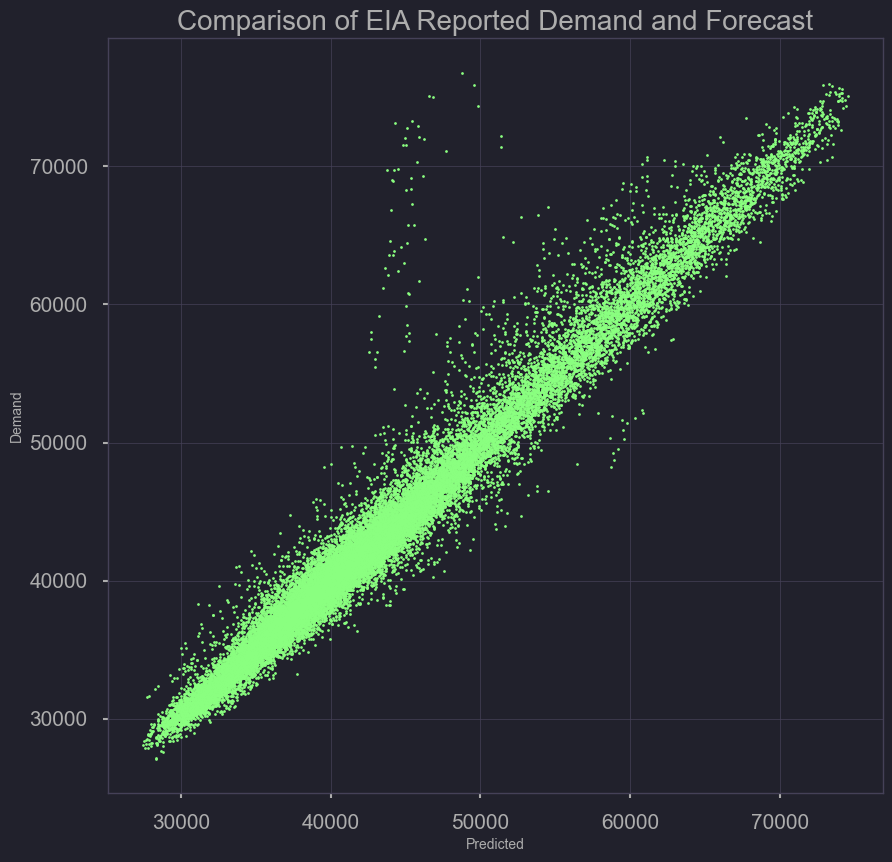

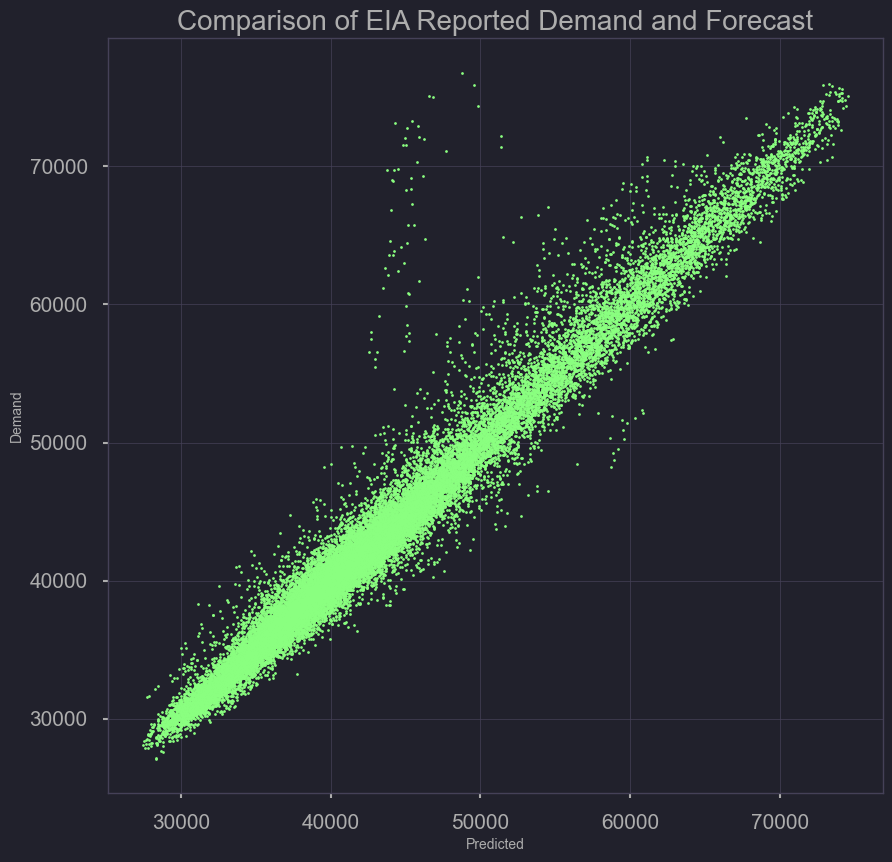

Actual Demand Versus US EIA Forecasted Demand (Baseline Model)

base_error = pd.DataFrame({'Demand': nrg['demand'],

'Predicted': nrg['forecast']})

plt.scatter(base_error['Demand'], base_error['Predicted'], s=2,c='red')

plt.xlabel('Predicted')

plt.ylabel('Demand')

plt.title('Comparison of EIA Reported Demand and Forecast')

plt.savefig('./output/comparing_base_demand_forecast_scatter.png')

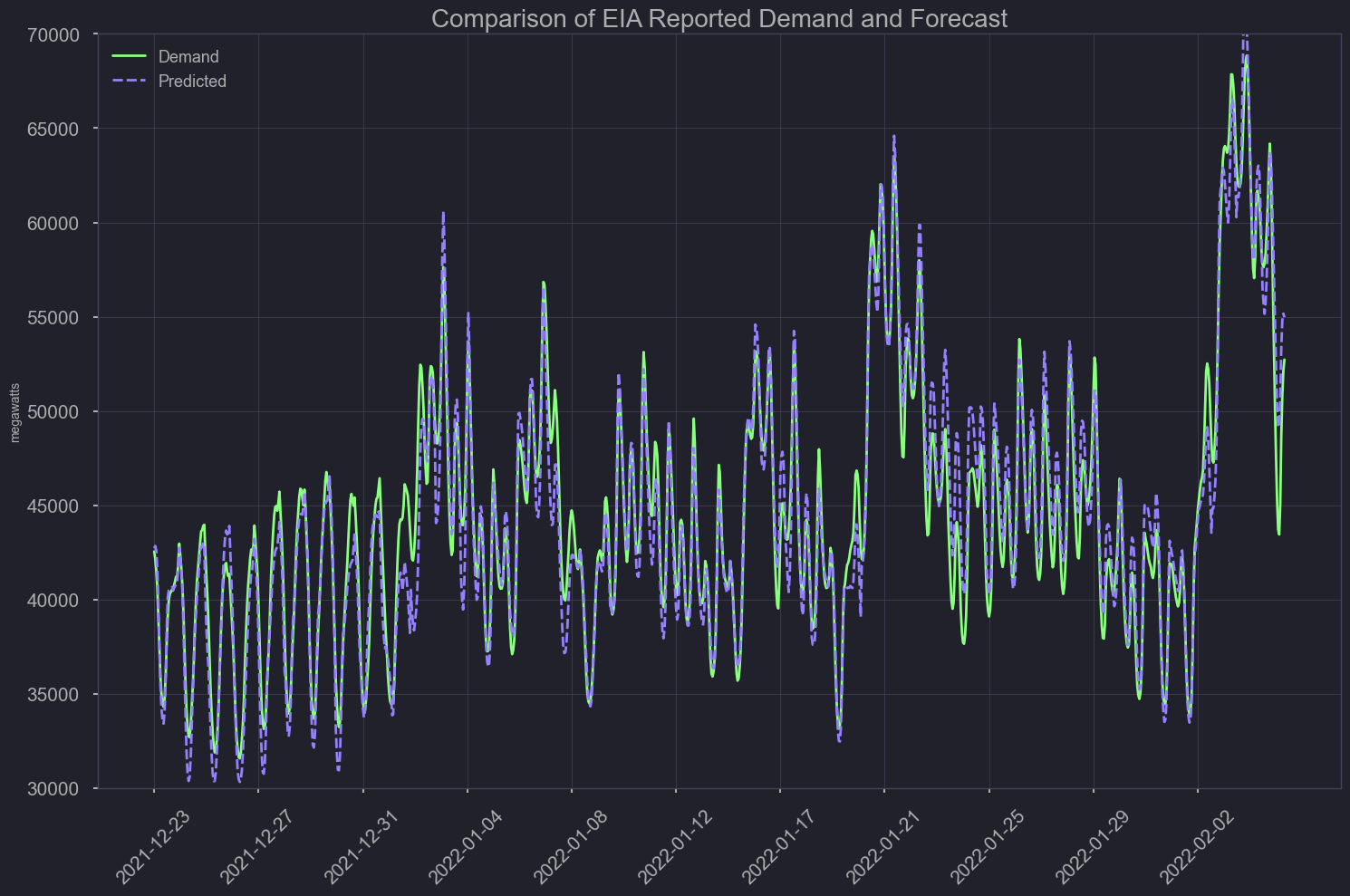

last Month and a Half

df = base_error

df = df[df.index > '2021-12-23']

df.sort_index(ascending=True, inplace=True)

plt.figure(figsize=(15, 5))

plt.style.use('ggplot')

sns.lineplot(data=df[['Demand','Predicted']], palette=['#001011', 'red'])

plt.ylabel('megawatts')

plt.xlabel('')

plt.ylim(bottom=30000, top=70000)

plt.xticks(ticks=df.index[::100], rotation=45)

plt.title('Comparison of EIA reported demand and forecast')

plt.tight_layout()

plt.savefig('./output/comparing_base_demand_forecast_line.png')

plt.show();

Baseline Model Metrics

df = base_error

df['Error'] = df['Demand'] - df['Predicted']

#BASE MODEL METRICS

mae_function(df)

Bias: -173.09, -0.39%

MAE: 1107.15, 2.53%

RMSE: 1830.83, 4.18%

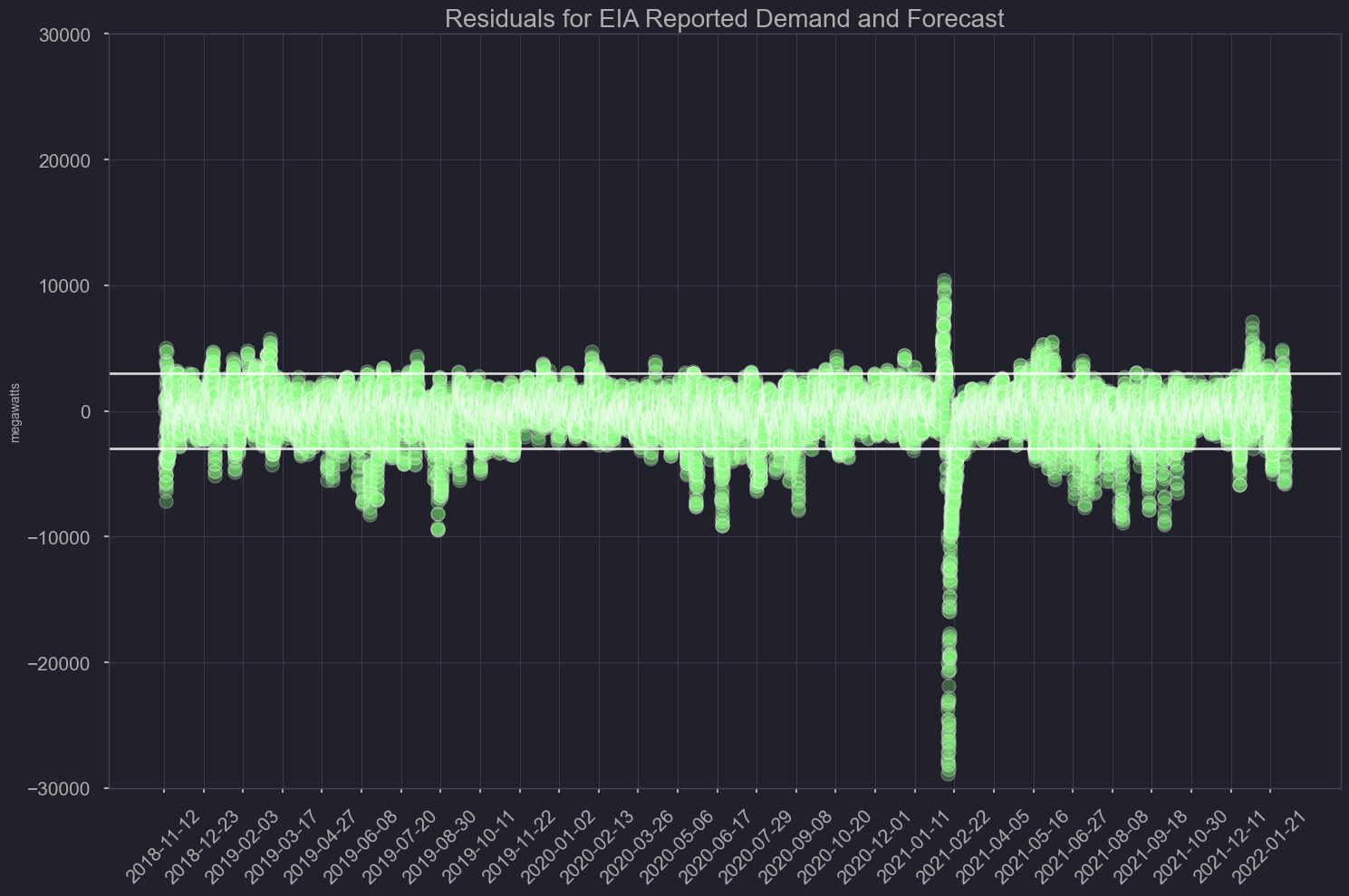

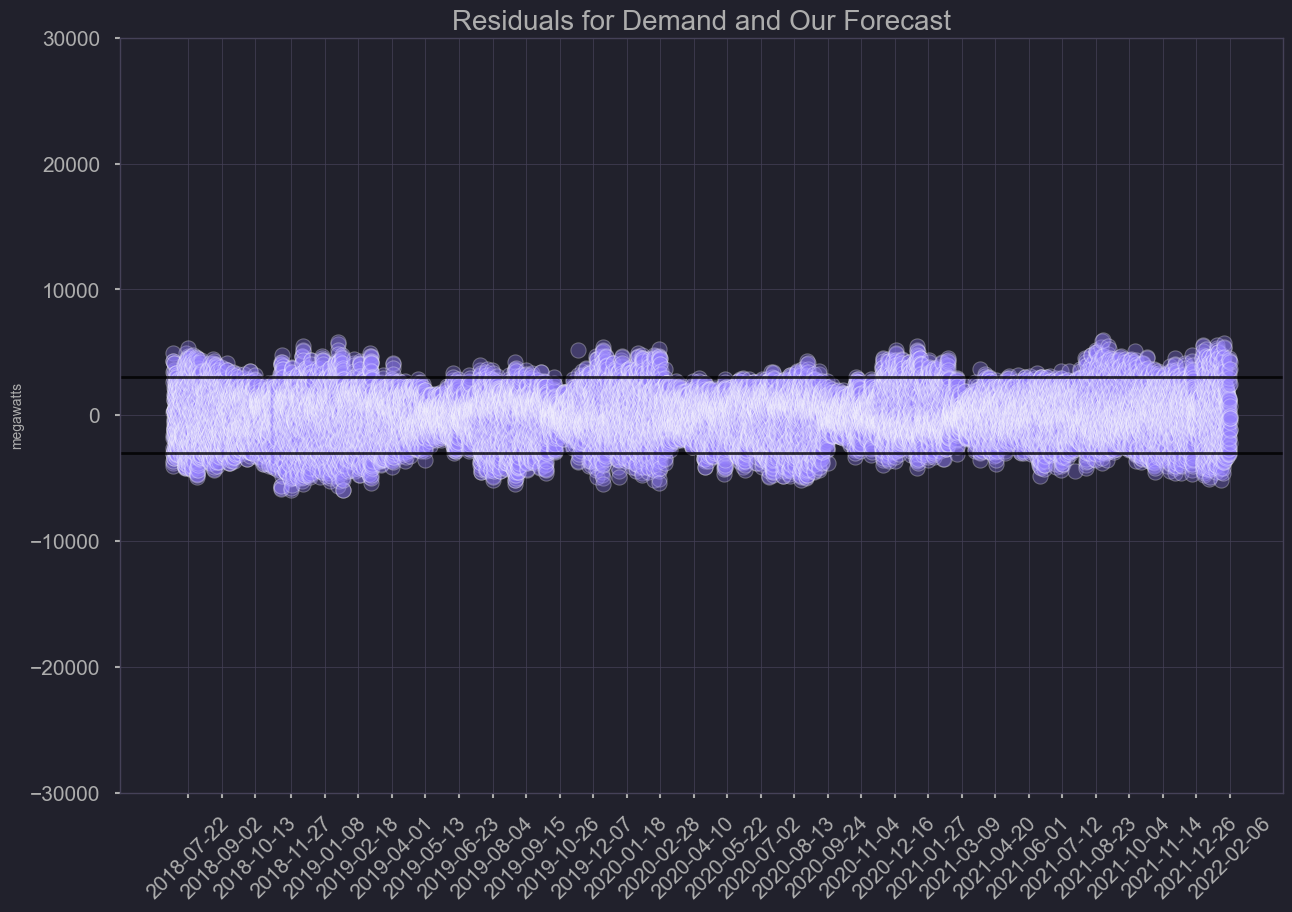

Residuals

df.sort_index(ascending=True, inplace=True)

plt.figure(figsize=(25,5))

sns.lineplot(x=df.index,y=df['Error'], linestyle='',marker='o', alpha=0.3)

plt.ylabel('megawatts')

plt.xlabel('')

plt.ylim(bottom=-30000, top=30000)

plt.xticks(ticks=df.index[::1000], rotation=45)

plt.title('Residuals for EIA reported demand and forecast')

plt.style.use('ggplot')

plt.axhline(y = 3000, color='black', linewidth=2, alpha=.8)

plt.axhline(y = -3000, color='black', linewidth=2, alpha=.8)

plt.tight_layout()

plt.savefig('./output/basemodel_residuals.png')

plt.show();

biased towards forecast being greater than actual demand, that’s preferable since excess energy can always be sent off but not generating enough can pose a major threat to the grid.

Our Model

from datetime import datetime

parser = lambda x: datetime.strptime(x, '%Y%m%dT%HZ')

nrg = pd.read_csv('./data/all_erco_energy.csv', parse_dates=['datetime'], date_parser=parser)

nrg = nrg.dropna()

d = nrg['demand']

test = exp_smooth_funct(d, slen=12000, extra_periods=1, alpha=0.4, beta=0.4, phi=0.8, gamma=0.2)

mae_function(test)

Bias: -0.93, -0.00%

MAE: 1337.39, 3.03%

RMSE: 1687.98, 3.83%

Rejoin date-time to model output

#print(nrg.head())

#print(test.head(5))

#print(nrg.tail())

#print(test.tail(5))

nrg.reset_index(inplace=True)

nrg.head(5)

| index | datetime | demand | plant | net_generation | coal | hydro | natural_gas | nuclear | other | solar | wind | total_interchange | forecast | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 11 | 2022-02-06 06:00:00 | 51910.0 | ERCO | 51687.0 | 8792.0 | 10.0 | 17825.0 | 5144.0 | 121.0 | 0.0 | 19795.0 | -222.0 | 51511.0 |

| 1 | 12 | 2022-02-06 05:00:00 | 52424.0 | ERCO | 52179.0 | 9077.0 | 10.0 | 17796.0 | 5144.0 | 122.0 | 0.0 | 20030.0 | -245.0 | 53249.0 |

| 2 | 13 | 2022-02-06 04:00:00 | 52723.0 | ERCO | 52350.0 | 9022.0 | 11.0 | 18119.0 | 5143.0 | 128.0 | 0.0 | 19925.0 | -372.0 | 54965.0 |

| 3 | 14 | 2022-02-06 03:00:00 | 52136.0 | ERCO | 51572.0 | 8382.0 | 30.0 | 17950.0 | 5144.0 | 146.0 | 0.0 | 19921.0 | -563.0 | 55162.0 |

| 4 | 15 | 2022-02-06 02:00:00 | 50843.0 | ERCO | 50199.0 | 8531.0 | 30.0 | 18028.0 | 5144.0 | 145.0 | 0.0 | 18323.0 | -643.0 | 54814.0 |

test = test[0:31460]

test_error = pd.DataFrame({'Demand': test['Demand'],

'Predicted': test['Forecast'],

'Resid': test['Error'],

'datetime': nrg['datetime']})

#print(test_error.head(5))

#print(test_error.tail(5))

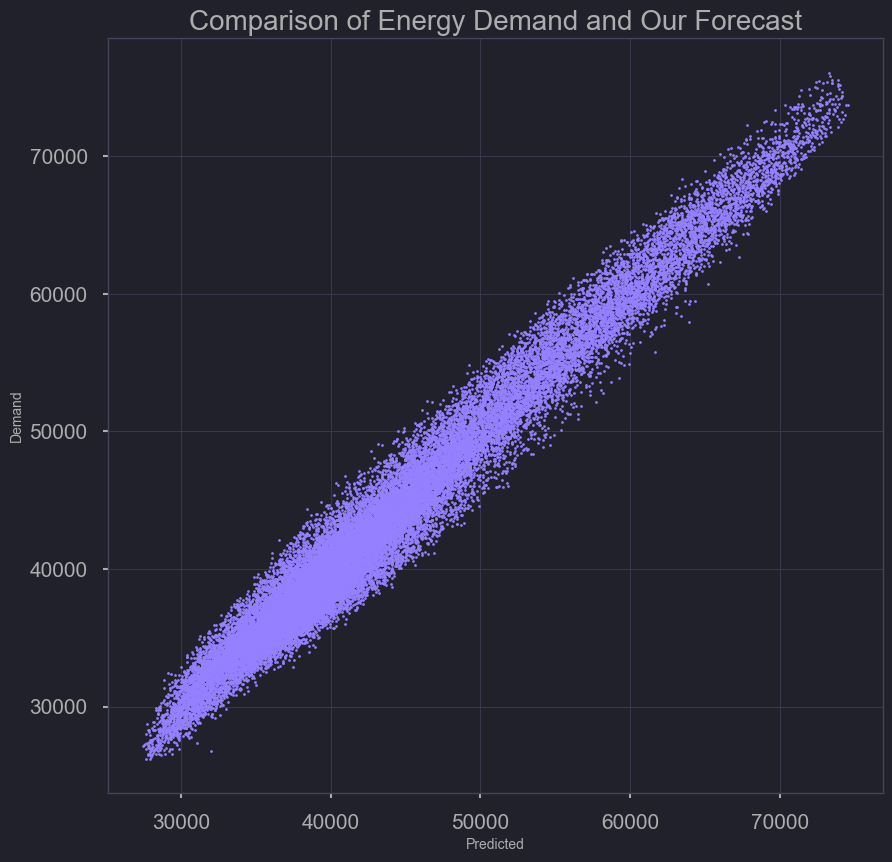

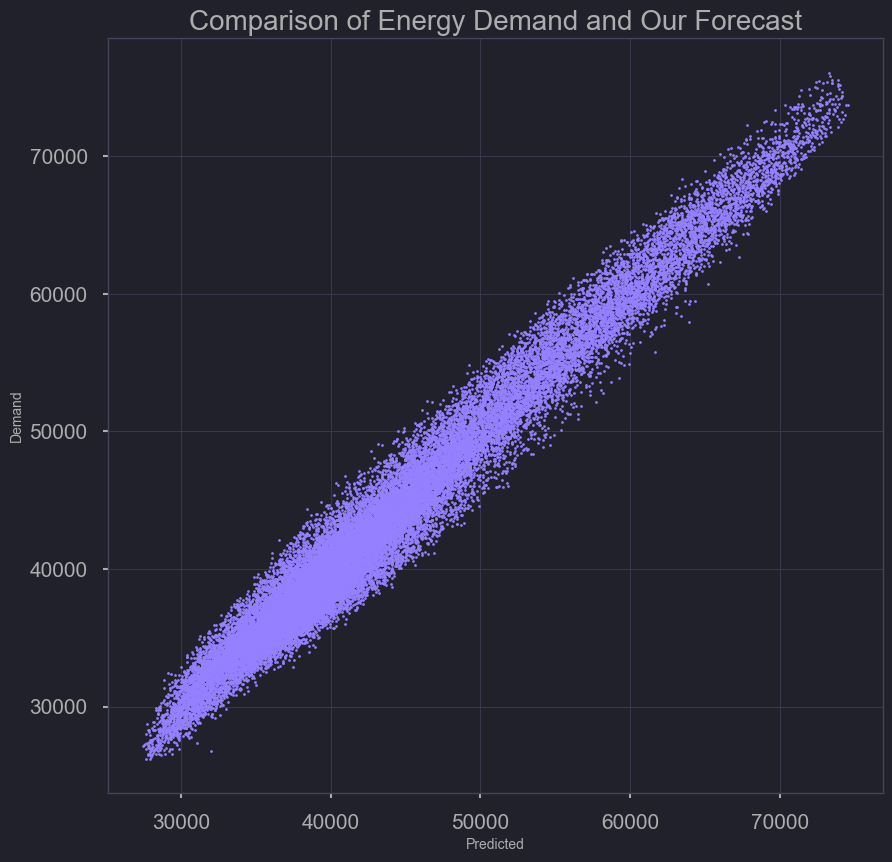

Model Performance (predicted versus demand)

plt.scatter(test_error['Demand'], test_error['Predicted'], s=2, c='purple')

plt.xlabel('Predicted')

plt.ylabel('Demand')

plt.title('Comparison of Energy Demand and our Forecast')

plt.savefig('./output/comparing_test_demand_forecast_scatter.png')

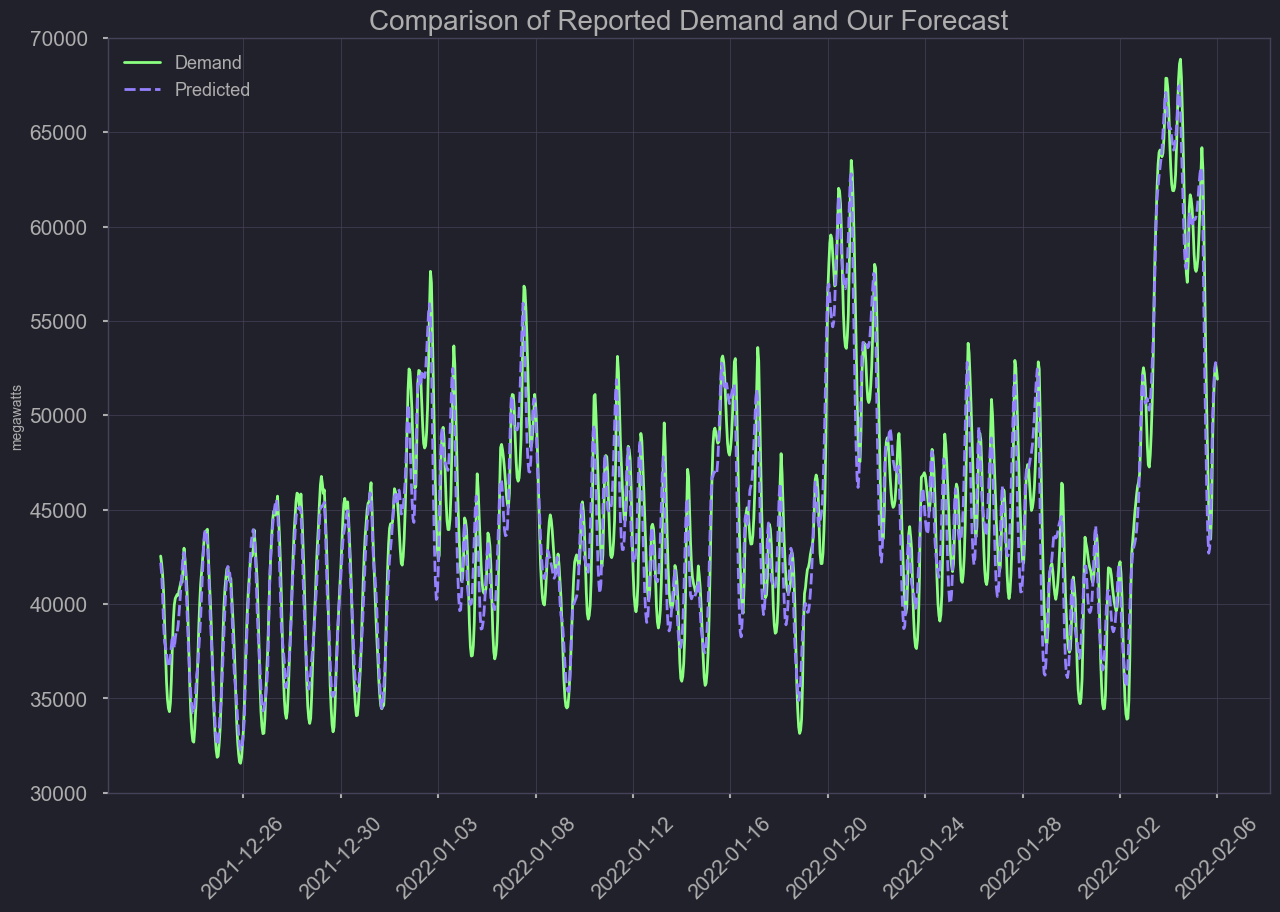

df = test_error[test_error['datetime'] > '2021-12-23'].set_index('datetime')

plt.figure(figsize=(25, 6))

plt.style.use('ggplot')

sns.lineplot(data=df[['Demand','Predicted']], palette=['#001011', 'red'])

plt.ylabel('megawatts')

plt.xlabel('')

plt.ylim(bottom=30000, top=70000)

plt.xticks(ticks=df.index[::100], rotation=45)

plt.title('Comparison of reported demand and our forecast')

plt.savefig('./output/comparing_ourmodel_demand_forecast1.png')

plt.show();

Residuals

df= test_error

df= test_error.set_index('datetime')

plt.figure(figsize=(25, 6))

plt.style.use('ggplot')

sns.lineplot(x=df.index,y=df['Resid'], linestyle='',marker='o', alpha=0.3)

plt.ylabel('megawatts')

plt.xlabel('')

plt.ylim(bottom=-30000, top=30000)

plt.xticks(ticks=df.index[::1000], rotation=45)

plt.title('Residuals for demand and our forecast')

plt.axhline(y = 3000, color='black', linewidth=2, alpha=.8)

plt.axhline(y = -3000, color='black', linewidth=2, alpha=.8)

plt.savefig('./output/ourmodel_residuals.png')

plt.show();

Model Comparison

Our Model

- Bias: -0.93, -0.00%

- MAE: 1337.39, 3.03%

- RMSE: 1687.98, 3.83%

- Neutral Bias (better than + still)

- Higher absolute error

- RMSE lower due to anomaly handling

EIA 24 Hour Forecast Model

- Bias: -170.04, -0.39%

- MAE: 1099.16, 2.51%

- RMSE: 1821.58, 4.16%

- Negative Bias (better than +)

- Better absolute error

- RMSE higher due to poor performance during anomalies

Overall our model is not as influenced by irregularities. Over time the pattern in demand has changed, and thus a model too reliant on historical data can have it’s weaknesses. Each year’s peaks days seem to fluctuate, based on more frequent, record breaking weather events. Even though the model only predicts 1 hour ahead of time, it could still serve as an additional tool for power operators. (more accurate during irregular peaks in demand)

Final Thoughts, Next steps

As events like the 2021 Texas power crisis become more common with climate change and aging US energy grid infrastructure, it becomes increasingly important for the public to understand where their power comes from and how overall energy demand may affect them. In our exploratory data visualizations we show patterns of renewable power generation that can be useful for individuals who are interested in timing their use to minimize their carbon footprint.

For example, individuals can use this type of demand forecast to time their power usage to lower cost times, such as for electric vehicle charging. Providing accurate energy demand forecasts are also important for energy grid operators.

We developed a simple set of 1 hour forecast models that have the advantage of being fast and scalable (as opposed to ARIMA forecasts and others). Our triple smoothed exponential models are a good choice for streaming forecasts online. In addition, these types of models are not as influenced by long-past exogenous events such as previous-annual holidays. This allows them to follow recent patterns better.

Our next goal is to create a site where people can view the average breakdown of the source of their electricity along with a predicted price available on an hourly basis. We will utilize the api functions along with the models we created to predict demand to ultimately aid in predicting the electricity price for residents.

The next steps will be to find sources of electricity data that we can pull on a regular basis to tune our models on and feed into a Streamlit app that end-users can interact with. We believe that giving end-users the ability to know what their electricity price will be in the future along with the composition of the sources will allow them to make informed decisions on their energy use.